Cup And Handle Formation

Contents

The Cup with Handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It was developed by William O’Neil and introduced in his 1988 book, How to Make Money in Stocks. ✅This pattern is not as popular among traders as „Head and Shoulders“, „Double Top“ and other classic patterns of technical analysis. However, this does not mean that it is not so effective.

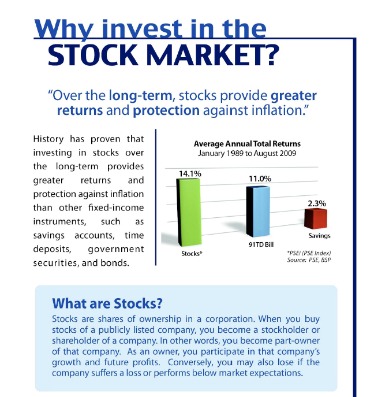

Cup and handle pattern is indicative of bullish signals or an uptrend. Moreover, when you are looking at the right side, you can see that trade volume decreases in that corner. There isn’t a stock scanner setting you can use to find a cup and handle pattern, but the pattern is easy to recognize visually. If you set your stock scanner to meet your other trading needs, then you can flip through the results until you find a chart that looks like a cup and handle. For example, a day trader may scan for stocks with a high average true range , and a swing trader might search for stocks that have performed well in recent weeks. The cup and handle chart patterns triggers a signal when it breaks out of the handle.

The volume function is often used in stock trading as a spike in volume indicates the breakout which confirms the entry signal. There are two potential profit target levels for this pattern. The first profit target is estimated by measuring a distance equivalent to the size of the handle, starting from the breakout point.

When you layer the volume on top of the price action, they both can look like two Us on the chart. Sometimes they look like a bearish cup and handle breakdown. Second, O’Neil basically says it’s not an exact science. He observed hundreds of variations — both successful and failed cup and handle patterns.

StocksToTrade in no way warrants the solvency, financial condition, or investment advisability ofany of the securities mentioned in communications or websites. In addition,StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any useof this information. Look for a roughly 30% downward move, an inverted U-shaped correction, and a bounce handle. The handle will typically form a descending trendline … Take a look at the chart below for an example.

The cup and handle pattern is considered to be a bullish continuation pattern therefore, identifying a prior uptrend is essential. This can be done using price action techniques or technical indicators such as the moving average. Akamai Technologies, Inc. consolidated below $62 after pulling back to major support at the 200-day exponential moving average .

The founder of the term, William O’Neil, identified four primary stages of this technical trading pattern. First, approximately one to three months before the “cup” pattern begins, a security will reach a new high in an uptrend. Second, the security will retrace, dropping no more than 50% of the previous high creating a rounding bottom. Third, the security will rebound to its previous high, but subsequently decline, forming the “handle” part of the formation. Finally, the security breaks out again, surpassing its highs that are equal to the depth of the cup’s low point.

Cup and Handle Formation in Penny Stocks

It returned to resistance in early February of 2015 and dropped into a small rectangle pattern with support near $60.50. Or cup and saucer pattern is a very long term chart pattern can take a lot of time to form. This is a very reliable chart pattern and typically offers a very low risk compared to the rewards.

If you can see what other https://topforexnews.org/rs are seeing and determine how they are thinking, you can make smarter decisions and trade more effectively. The inverted cup and handle is the opposite of the pattern I just broke down. You can think of it as an upside-down cup with a handle. The best place to enter a trade using this pattern is when the handle forms. The round shape indicates consolidation, and that’s a good thing. If the cup is in a V-shape, the reversal will be too sharp of a movement.

The 2 Most Effective Momentum Indicators

In fact, the „Cup & Handle“ pattern is in no way inferior to the above patterns in its reliability and, if used correctly, can bring considerable benefits to the… There is a risk of missing the trade if the price continues to advance and does not pull back. The cup and handle is a chart pattern with a bullish pattern. Now that you’ve seen the bearish cup with handle signal, you can begin to pursue the bearish potential of the pattern. This acted as a confirmation of the bearish cup and handle formation.

So, they https://en.forexbrokerslist.site/ the shares and the selling pressure leads to the formation of a resistance line. SQQQ price closing on 50.24 USD where on the breakout of resistance level 48.68 USD yesterday. This pattern also represents a buying opportunity after the asset moves past the previous resistance point, which is near the right side of the bowl.

The https://forex-trend.net/ follows the classic pullback expectation, finding support at the 50% retracement in a rounded shape, and returns to the high for a second time 14 months later. The stock broke out in October 2013 and added 90 points in the following five months. As with the above example, the ideal point of entry to trade this pattern is the break out of the small handle or down sloping channel. If you look closely at the handle, it is nothing but a bullish flag pattern, which, as we know is a continuation pattern.

- The subsequent decline ended within two points of theinitial public offering price, far exceeding O’Neil’s requirement for a shallow cup high in the prior trend.

- On 14th January 2022, the stock hit a high of Rs. 1,507.45 which is just above our smaller price target.

- The reflection of human emotions is seen in the chart and the formation of the handle takes place.

- So much depends on volume and volatility in effect at the moment.

- Then check the validity of those patterns and place any potential orders in the remaining 10 minutes.

- If it doesn’t, the stock’s momentum may not be enough to break through the higher resistance level.

Can the cup and handle fail or turn out as a false signal? All reversal and continuation patterns are indications only, and cannot ever lead to 100% confidence. Handle should be understood as a consolidating offset against the bullish movement in the greater scheme of price behavior. As a pullback, the handle is a short-term aspect of the pattern. Because it is a retracement, the caveat for all retracements applies here. Expect a relatively short-term period of time in order to predict a strong continuation of the bullish trend.

Awesome Charting With StocksToTrade

The candles of the handle should have small bodies and in a very tight range. The Trading Challenge is the most comprehensive trading course I offer. You get access to DVDs, archived webinars, and video lessons.

Note that you should begin to measure the distance right from the breakout point. This is the lowest level of the handle and it has been shown with a red line marked Stop Loss. This is a great opportunity for you as a trader to go long. This is followed by a significant increase in the price of the currency pair. This has been shown on the chart using a red arrow marked as Bullish Breakout through the Handle. The cup and the handle have been shown using blue lines.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Note that you have the option of closing your trade immediately you reach your second target, that is, Target 2. The second position to take your profit has been marked as Target 2.

How to Trade the Cup and Handle

So I don’t go on the hunt for the cup and handle pattern. But — and this is super important — a lot of traders do. Always test the strategies you’re going to trade before you put any real money on the line.